Headlines

Digital Payments Surge in Kano Amid Cash Crunch

Zulaiha Danjuma

The rise of digital payment systems in Nigeria has transformed the way people conduct financial transactions.

KANO FOCUS reports, In Kano, traders in the Hausawa Sabon Titi community have been at the forefront of this shift, embracing digital payment solutions to facilitate their daily business activities.

The introduction of the MoniePoint POS machine has revolutionized businesses in the area. Mr. Kabiru Yahaya, a provision store owner, noted that the cash squeeze prompted him to adopt the MoniePoint POS machine. “Most of our customers prefer to pay electronically, so we had to adapt to meet their needs,” he explained.

Similarly, Yusuf Usman, a bread and tea vendor, reported that 85% of his customers use ATM cards, mobile wallets, or phone transfers to make payments. “The MoniePoint POS machine has made it easier for me to receive payments and make payments to suppliers too,” he said.

Provision Shop at Sabontiti, Kano

Benefits of Inclusive Instant Payment Systems

The adoption of inclusive instant payment systems has not only improved business operations but also enhanced financial security. Mr. Usman noted that the use of digital payments has reduced the risk of robbery and burglary.

Inclusive instant payment systems offer several benefits

Increased financial inclusion: IIPS provides access to financial services for underserved populations, promoting economic growth and development. According to the Central Bank of Nigeria (CBN), the number of Nigerians with access to financial services increased from 36.8% in 2016 to 63.2% in 2020.

Improved economic efficiency: Digital payments reduce transaction costs, increase the speed of transactions, and enhance the overall efficiency of the economy. A study by McKinsey found that digital payments can increase GDP by up to 6% in some African countries.

Reduced risk of cash transactions: IIPS minimizes the risks associated with cash transactions, such as robbery, burglary, and counterfeiting. According to the Nigerian Inter-Bank Settlement System (NIBSS), the value of digital transactions in Nigeria increased by 50% in 2022, reaching ₦10.9 trillion.

Bread seller

Nigeria’s Cash Crunch Drives Digital Payments

Nigeria’s economy has traditionally relied heavily on cash transactions. However, the COVID-19 pandemic and subsequent lockdowns accelerated the adoption of digital banking and inclusive instant payment systems. The government’s efforts to curb excess cash circulation and promote digital payments have further driven the growth of IIPS.

According to data from the Central Bank of Nigeria (CBN), the number of active mobile money agents in Nigeria increased from 10,000 in 2019 to over 1.4 million in 2022.

Challenges and Limitations of IIPS

Despite the benefits of IIPS, there are challenges and limitations to its adoption. Some of these challenges include:

*Infrastructure constraints:* The lack of reliable internet connectivity and electricity in some areas can hinder the adoption of IIPS. According to the Nigerian Communications Commission (NCC), the country’s internet penetration rate stood at 44.6% as of 2022.

*Security concerns:* The risk of cyber attacks and data breaches can deter some individuals and businesses from adopting IIPS. According to a report by KPMG, the average cost of a data breach in Nigeria is estimated to be around ₦2.5 billion.

*Regulatory issues:* The lack of clear regulations and guidelines can create uncertainty and confusion for providers and users of IIPS. According to the Central Bank of Nigeria (CBN), the regulator is working to develop a more comprehensive regulatory framework for digital payments in Nigeria.

Expert Reaction

Dr. Tijjani Ahmed, a Senior Lecturer at the Hussaini Adamu Federal Polytechnic Kazaure and a Research Fellow at the African Center for Tax and Governance, explained that the advancement of digital technology and the introduction of digital instant payments have increased financial inclusion for small businesses.

Dr. Tijjani Ahmed

“Prior to 2015, Nigeria had experienced low financial inclusion, with over 40% of the populace financially excluded,” he explained. Dr. Ahmed noted that this excluded demographics were not just individuals but also businesses that were in need of financial inclusion.

“Largely, the businesses in Northern Nigeria are informal, and one of the requirements in this modern age is to be banked and run a business account,” he said.

Dr. Ahmed added that with the advent of inclusive instant payment services like MoniePoint, the majority of small businesses are now able to be involved in the financial system, making and receiving payments, paying bills, and keeping track of their financial inputs and outputs.

“The Nigerian government has a target to phase out cash transactions by 2030; these digital financial technologies will help this transition, making businesses resilient because without these financial inclusive platforms and no cash, business will die,” he said.

The adoption of inclusive instant payment systems in Nigeria has transformed the way people conduct financial transactions. As the country continues to navigate its cash crunch, the growth of IIPS is expected to drive financial inclusion, improve economic efficiency, and reduce the risks associated with cash transactions. With the increasing adoption of IIPS, Nigeria is poised to make significant strides in promoting financial inclusion and driving economic growth.

As the country continues to evolve and adapt to the changing financial landscape, it is essential to address the challenges and limitations associated with IIPS to ensure its sustainable growth and development.

This story is produced under the Digital Public Infrastructure (DPI) Fellowship of the Media Foundation for West Africa (MFWA) and Co-Develop in partnership with Kano Focus Newspaper online.

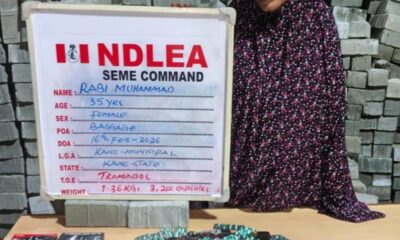

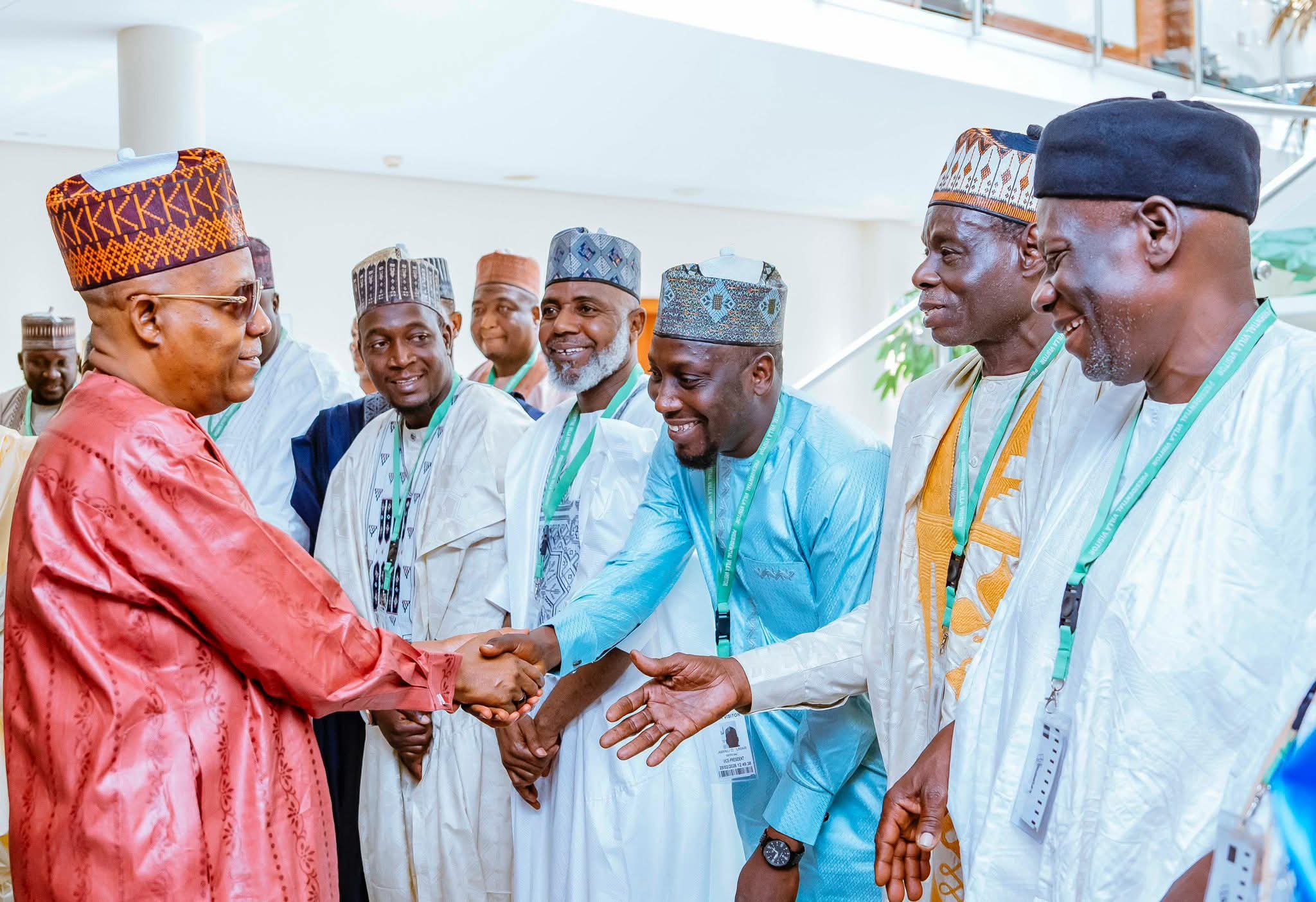

Headlines

Kano business community thanks FG for N5bn Singer market relief

Nasiru Yusuf Ibrahim

Nigeria’s Vice President, Kashim Shettima, on Tuesday received a delegation from the Association of Kano Business Community at the Presidential Villa, Abuja, during a thank-you visit to President Bola Ahmed Tinubu.

KANO FOCUS reports that the delegation expressed appreciation to the Federal Government for its support to traders and other victims affected by the recent fire incident that razed several sections of the popular Singer Market in Kano.

Speaking during the meeting, the Vice President reaffirmed the Federal Government’s commitment to collaborating with the Kano State Government and relevant agencies to prevent a recurrence of fire outbreaks in markets across the state.

He assured the delegation that President Tinubu has the interests of Kano people at heart, noting that the N5 billion approved as immediate relief for victims was based on the findings of a preliminary assessment of the damage caused by the inferno.

Shettima reiterated that the Federal Government would continue to support efforts aimed at restoring commercial activities and strengthening safety measures in markets to protect lives and property.

Headlines

Kano Govt inaugurates 23-member committee to disburse Singer market fire relief

Nasiru Yusuf Ibrahim

The Kano State Government has inaugurated a 23-member committee to oversee the transparent and equitable distribution of financial assistance and relief materials to victims of the recent Singer Market fire disaster.

KANO FOCUS reports that the inauguration was carried out on behalf of the Secretary to the State Government, Umar Faruq Ibrahim, who chairs the committee. The event was presided over by the state Attorney-General and Commissioner for Justice, Abdulkarim Kabiru Maude.

According to the Attorney-General, the committee comprises representatives from key government agencies, security services, the Kano Emirate Council, religious leaders, and affected traders.

He said the panel’s mandate includes assessing the extent of losses, verifying genuine victims, ensuring timely distribution of support, and recommending measures to prevent future fire incidents.

The intervention follows support approved by President Bola Ahmed Tinubu, as well as contributions from the APC Governors Forum. It also comes in addition to earlier assistance provided by Governor Abba Kabir Yusuf and the Deputy Senate President, Barau I. Jibrin.

The state government reaffirmed its commitment to supporting victims of the disaster and restoring commercial activities at Singer Market.

Headlines

Kano Govt announces March 1 for schools’ Ramadan break

Nasiru Yusuf Ibrahim

The Kano State Government has announced Saturday, March 1, 2026, as the commencement date for the Eid-el-Fitr break for all public and private primary and post-primary schools in the state.

KANO FOCUS reports that the announcement, contained in the approved 2025/2026 academic calendar, applies to both day and boarding schools across the state.

According to a statement issued by the Director of Public Enlightenment, Musbahu Aminu Yakasai, parents and guardians of pupils and students in boarding schools are expected to convey their wards home by the early hours of Friday, February 28, 2026.

The statement further explained that boarding school students are to resume on Sunday, March 22, 2026, while day students are to resume on Monday, March 23, 2026.

It added that the second term will continue from Sunday, March 22, 2026, and end on Saturday, April 18, 2026.

The government directed all public and private schools in the state to comply strictly with the directive, warning that non-compliance would be treated as a breach of government instructions.

The Commissioner for Education, Ali Haruna Abubakar Makoda, urged parents and guardians to ensure full compliance with the approved resumption dates.

He appreciated parents and residents of the state for their continued cooperation and support to the ministry, and wished pupils and students a successful completion of the Ramadan fast and hitch-free Sallah celebrations.